Delivered by: Climate Smart Ventures, Pte. Ltd. (CSV) and Green Finance & Development Center (GFDC)

Beneficiary: Selected 6 Coal Fired Power Plants (CFPPs) in Southeast Asian country and Pakistan

The goal of this Transaction Advisory (TA) is to set the stage for a series of transactions to catalyse China’s exit from selected Coal Power Plants (CFPP) in Pakistan and Southeast Asian country.

1. Scope

2. Design

3. Deploy

Project Background

China pledged to stop funding CFPPs abroad in September 2021 and would instead support the development of low-carbon infrastructure and renewable energy to bolster its commitment to a green “Belt and Road Initiative”. While the move has been welcomed by the global community, less attention has been given to the fate of coal fired power plants already under construction and in operation by China in various countries. According to the World Resources Institute’s (WRI) China Overseas Financing Inventory (COFI) database released in 2022, Chinese debt and equity continue to support 51 coal plants in operation across Indonesia, Southeast Asian country, the Philippines, Malaysia and Cambodia, and 16 coal plants in Pakistan, Sri Lanka, and Bangladesh. Of these countries, Southeast Asian country and Pakistan have received sizeable investments from China state-owned enterprises (SOEs) in building and operating CFPPs. However, both countries have indicated willingness to explore early CFPP retirement as part of future plans. CSV worked together with GFDC to analyse industry conditions in Pakistan and Southeast Asian country to explore potential options on how China SOEs can support accelerated CFPP retirement in these countries.

Support Provided

CSV, together with GFDC, conducted a study on potential pathways for a China-led early CFPP retirement in Pakistan and Southeast Asian country using financial mechanisms available to the Chinese government and its SOEs. This study culminated in an article released to the public in October 2023. In completing the study, the team undertook the following processes:

- Due diligence and plant-by-plant analysis. Industry wide and Plant-level operating and financial data were collected, while various potential scenarios were gathered, along with country level data for both Pakistan and Southeast Asian country. The team completed the collection and review of data to be used in the study by June 2023. Respective country policies for CFPP operations for Pakistan, Southeast Asian country and China are also considered. Each CFPP in Pakistan and Southeast Asian country were assessed to determine which were suited for early retirement (see Figure 1 (Summarized Selection Criteria) for the criteria used).

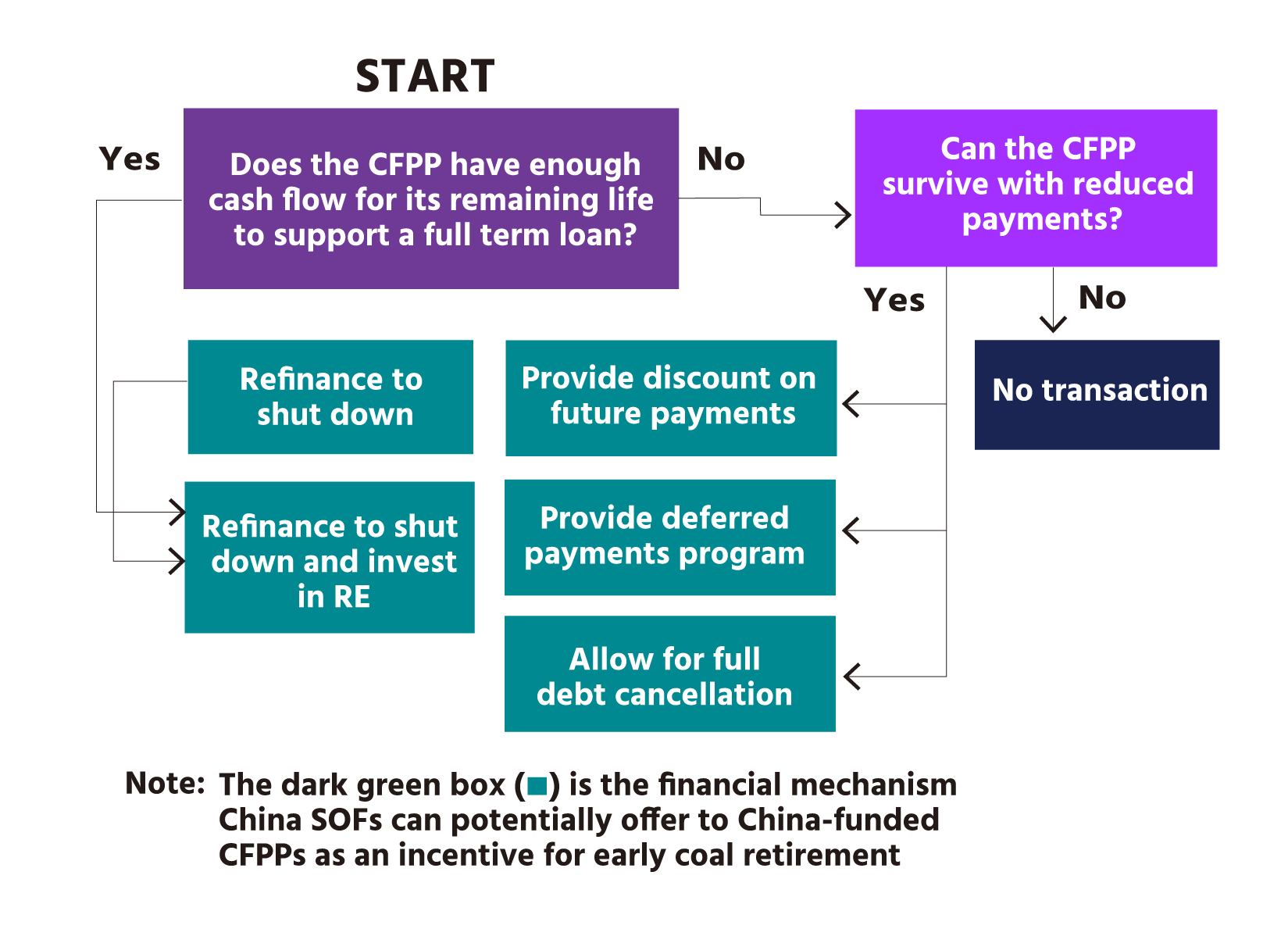

- Financial and Scenario analysis. A final set of CFPPs were selected for financial analysis, valuation and further evaluation based on their Net Present Value (NPV). Initial results from financial projections, including NPVs, were reviewed, iterated and analysed through a decision tree:

Figure 1: Sample Chinese SOE decision making tree

Once initial financial projections were set, additional scenario analysis was conducted based on the following potential financing structures and global economic scenarios:

Table 1: Scenarios based on selected financing structure

Business As Usual (BAU)

- CFPP operates up to its end of life

Asset/Portfolio Refinancing

- CFPP raises refinancing now and realises value but does not guarantee use of net proceeds for Renewable Energy (RE) development.

- CFPP is retired on the last payment year of its refinanced debt.

RE Bundling (combining coal and RE in a transaction)No debt forgiveness

- CFPP raises refinances now and reinvests net proceeds into RE

- CFPP is retired on the last payment year of its refinanced debt.

Table 2: Scenarios based on three global economic scenarios by 2035

Business As Usual (BAU)Countries prioritise energy security

- Continued operation of CFPP until end of economic life

- Subsidies for fossil fuels remain in place

- Gradual roll-out of renewable energy (RE)

- International and private investors are invited to support RE development

- Government promotes local manufacturing

- Voluntary carbon markets (VCM) continue to be a promise, yet will be implemented 2035 at the earliest

Choosing Your Allies (ALLIES) Regional blocs prioritise economic & political interests

- More prevalent economic & political hurdles and trade barriers; less global cooperation on high-tech products

- Generous international support for developing countries’ green transition

- Carbon Border Adjustment Mechanism (CBAM) charges 60-80% of the EU Emissions Trading Scheme (ETS) price for imported emissions

- Policies still favor RE, while entrenched interests and economic realities back local economic development, including mining, and require high local manufacturing content

Ministry of the Future (FUTURE) Global economy prioritises RE & climate action

- CFPPs are less used, translating to lower utilization facing increasing operating costs due to scarcity of suppliers and higher fuel costs

- RE is maximised, translating to lower cost of operations due to improved scale, but revenues are lower due to competition

- Global funding and trade support for the energy transition have accelerated

- Accelerated CBAM and 50% of its revenues are used for emerging markets’ energy transition

- VCM price is set at 50% of the EU ETS

- Financing for non-RE has mostly dried up, with few investors reaping high benefits from still financing CFPPS

- Green technologies are exempt from persisting trade barriers

- Higher localisation of RE and higher payment morale for elect

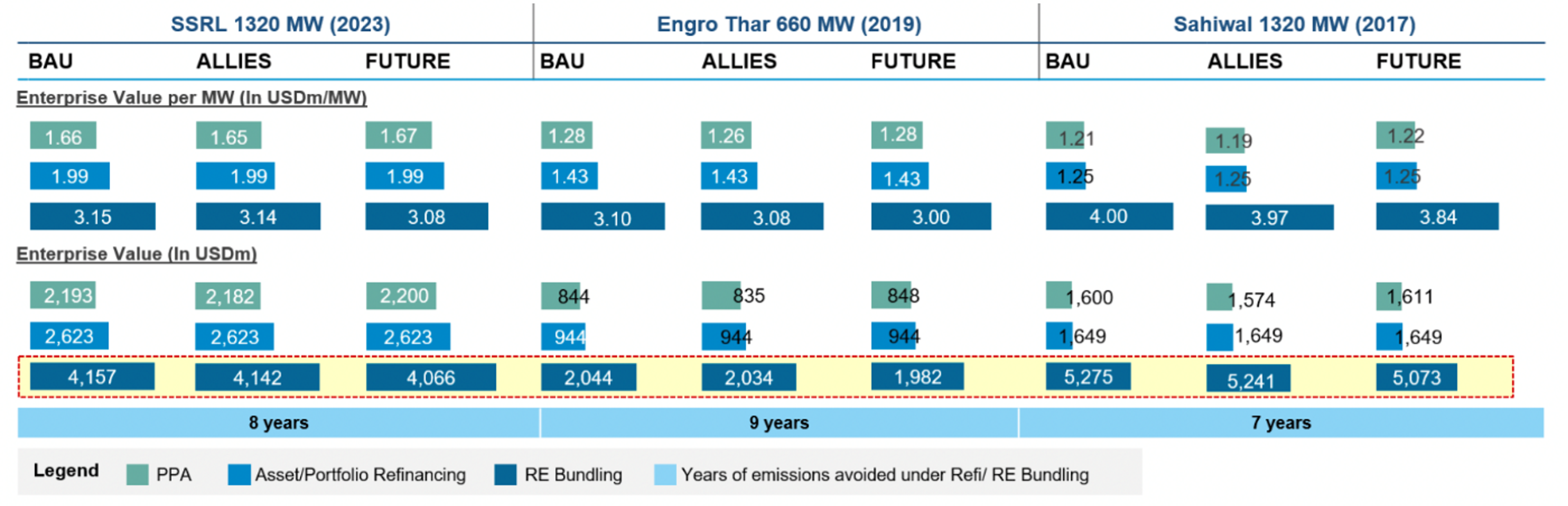

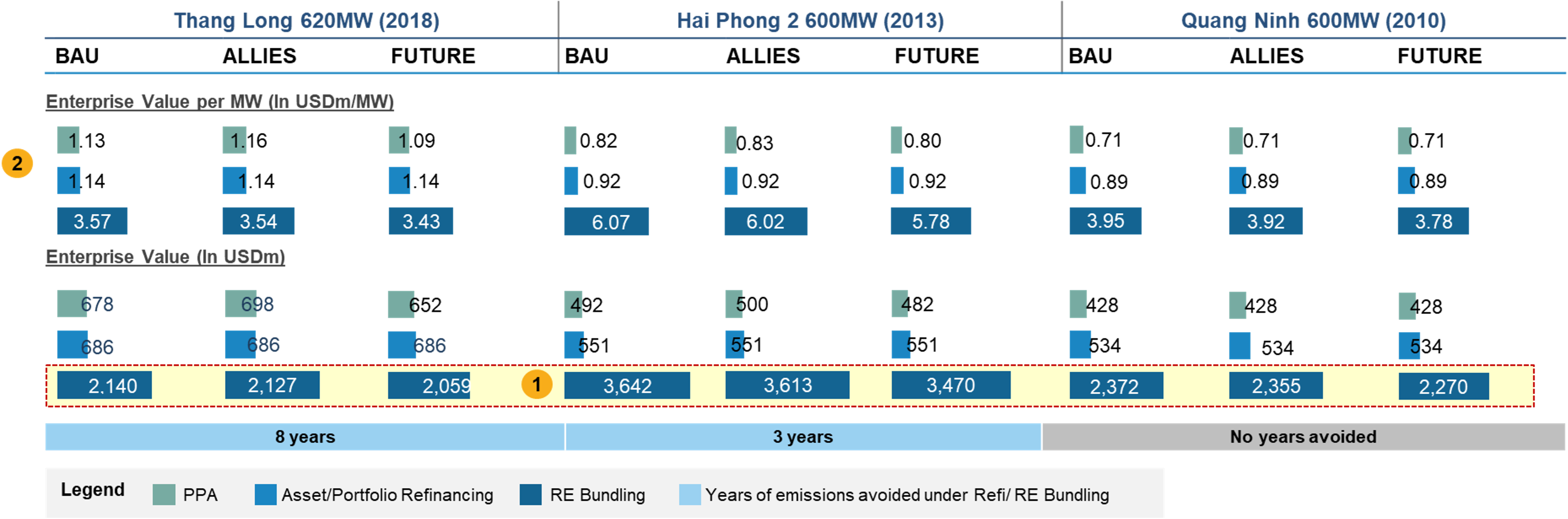

In undertaking the scenario analysis, each scenario in Table 1 (Scenarios based on selected financing structure) were paired with each scenario in Table 2 (Scenarios based on three global economic scenarios by 2035) to assess the financing situations and solutions depending on potential global economic scenario. Once all scenarios were combined and compared, a final financial analysis and comparison was done using enterprise value (EV)[1]per set of paired scenarios.

Results

CFPPs were assessed to determine which of the China-backed CFPPs were the most appropriate candidates for retirement. The target CFPPs for analysis were selected based on the following criteria:

Figure 1: Summarized Selection Criteria

Uses less efficient technologies

- Shutting down plants with less efficient carbon intensity technologies increases the avoided carbon emissions.

- CFPPS using Pulverised Coal (PC) or subcritical Circulating Fluidized bed (CFB) are prioritised for shutdown.

Generating less than 1,000 MW

- Prioritising smaller plants would simulate a more realistic CFPP transaction without compromising a country’s energy supply.

- Insights from shutdown of smaller plants cna be applied to bigger plants later on

Mix of different plant age brackets

- CFPPs of various ages have distinct remaining operational lives at a single point in time, which can produce different financial results.

- CFPPs from ‘young, middle, and old’ age brackets are prioritised to diversify the archetypes of CFPPS for early retirement.

Based on the above criteria, six CFPPs were selected:

| Southeast Asian country Plants | Technology | MW | Age (as of 2023) |

|---|---|---|---|

| Thang Long PS | CFB | 600 | 5 |

| Quang Ninh-1 | Subcritical | 600 | 13 |

| Hai Phong TPS2 | Subcritical | 600 | 10 |

| Pakistan Plants | Technology | MW | Age (as of 2023) |

|---|---|---|---|

| Engro Thar CFPP | Subcritical | 660 | 3 |

| SSRL Thar CFPP | Subcritical | 1320 (660MW x2) | 0 |

| Sahiwal CFPP | Supercritical | 1320 (660MW x2) | 6 |

Figure 2: Enterprise Values for CFPPs in Pakistan

Figure 3: Enterprise Values for CFPPs in Southeast Asian country

For all six CFPPs selected in Pakistan and Southeast Asian country, RE Bundling in all ‘FUTURE’ scenarios produces the highest valuation, while financing through their Power Purchase Agreements (PPAs) throughout their end of life yields the least Enterprise Values (BAU).

To facilitate early CFPP retirement, refinancing CFPPs at slightly-to-moderately lower than market rates (by 1-4%) in return for accelerated CFPP retirement and RE deployment is needed. This can generate positive NPV and EV compared to BAU. In addition, the perceived higher risk of operating CFPPs in the long run translates to higher discount rates reducing the value of future cashflows in BAU. This demonstrates how China-funded CFPPs can be supported to transition in a financially viable manner.

Proven Impact

Results from the study showed that Chinese SOEs can retain value and manage their CFPP exposure by accelerating plans to shift to renewable energy in Pakistan and Southeast Asian country, and still be able to deliver early CFPP retirement (RE Bundling). This also highlights the potential role of Chinese SOE’s in unlocking early CFPP retirement by providing transition finance through its developmental financial institutions. This allows them to use blended finance to lower borrowing costs and ultimately lead the shift to clean energy in Asia.

[1] Enterprise value (EV) measures a company’s total value which is computed using (i) the market capitalization of a company, debt (short-term and long-term) and any cash or cash equivalents.

The published report from this study can be accessed here: China coal exit: Opportunities for China-led financing of early phase down of coal-fired power plants in Pakistan and Southeast Asian country