Delivered by: RMI

Supported by: Coal Asset Transition Accelerator (CATA)

Beneficiary: Pelabuhan Ratu Coal Fired Power Plant

Country: Indonesia

Summary

In October 2022, ahead of Indonesia’s Just Energy Transition Partnership (JETP) announcement, PT PLN and PT Bukit Asam announced a partnership to target the accelerated transition of the Pelabuhan Ratu coal-fired power plant. The 1,050 MW plant, commissioned in 2013, was identified as one of the first projects under Indonesia’s Energy Transition Mechanism (ETM) Country Platform. Its early retirement is seen as a critical opportunity to continue demonstrating proof-of-concept and build momentum for further ETM and JETP implementation.

Indonesia’s power sector is heavily reliant on coal, particularly in the densely populated Java-Bali grid. With publicly stated goals of peaking power-sector emissions by 2030 and reaching net-zero by 2050, the country faces the challenge of expediting the transition of coal-fired power plants while balancing financial, policy, regulatory, and social considerations.

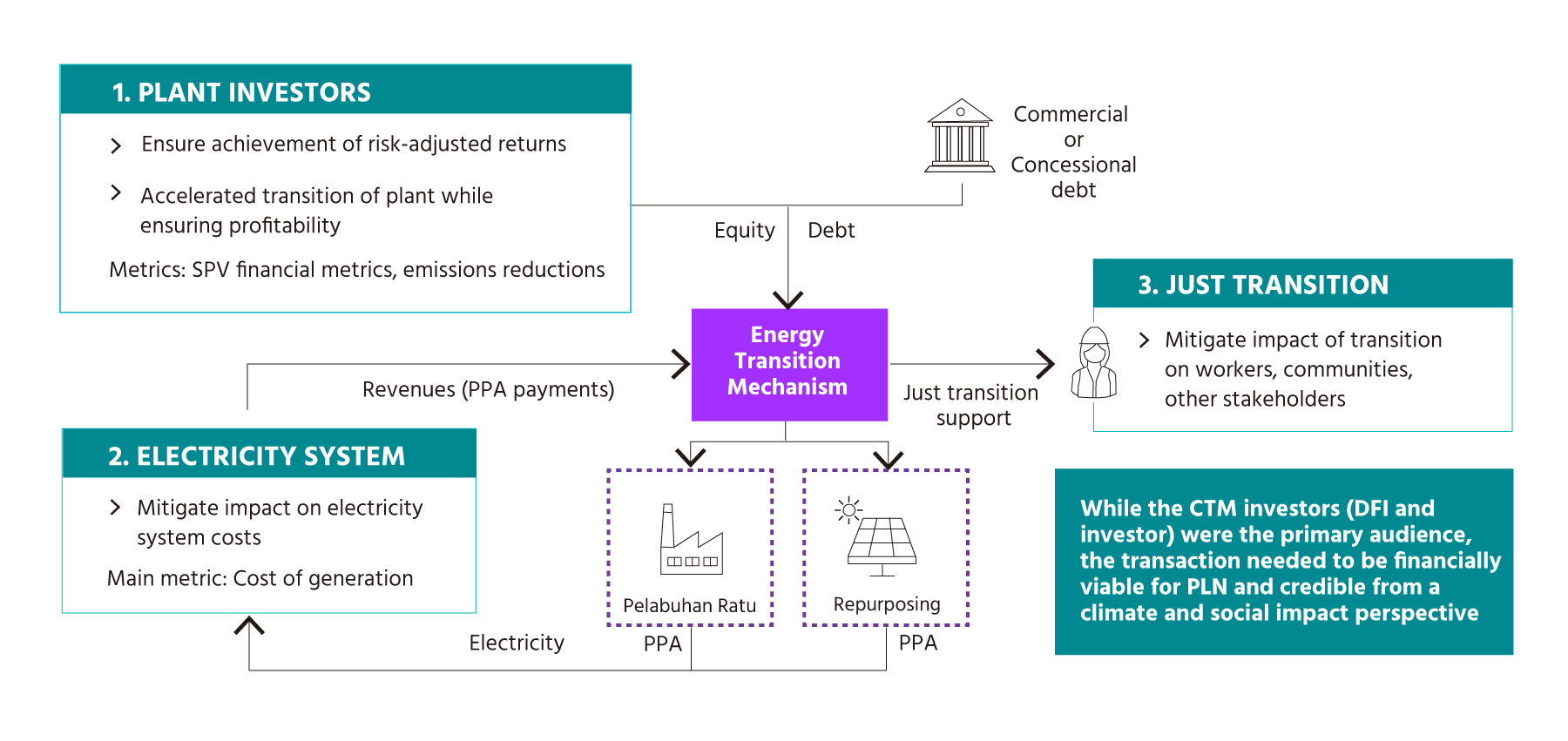

To support this initiative, RMI, with assistance from the Coal Asset Transition Accelerator (CATA), undertook a technical study to design a Coal Transition Mechanism (CTM). The objective was to identify financial and operational options that could encourage early retirement or repurposing of the plant, while taking into account local system needs, economic impacts, and political realities.

Approach

RMI, under the Coal Asset Transition Accelerator (CATA), conducted a multi-scenario, asset-level pre-feasibility analysis of Pelabuhan Ratu to inform decision-making for key project stakeholders. The study applied both financial modeling and system-dispatch analysis to capture the impacts of early retirement and potential site repurposing for investors, the electricity system, and surrounding communities.

- Financial Structuring and CTM Design

The analysis tested coal transition mechanism (CTM) options, including concessional and blended financing. It modeled cash flows, equity returns, and tariff implications under different scenarios, comparing early retirement scenarios with continued coal operation.

- System-Level Modeling

A marginal-cost dispatch model simulated how Pelabuhan Ratu’s retirement would affect overall system costs, CO₂ emissions, renewable curtailment, and storage requirements on the Java-Bali grid. - Socio-Economic Considerations

Just transition costs for workers and surrounding communities were included, highlighting the importance of balancing financial feasibility with social equity.

Key Findings

The Pelabuhan Ratu analysis examined four transition scenarios: continued coal operation, early retirement without repurposing, early retirement with solar + storage repurposing, and biomass co-firing. The analysis yielded four key insights:

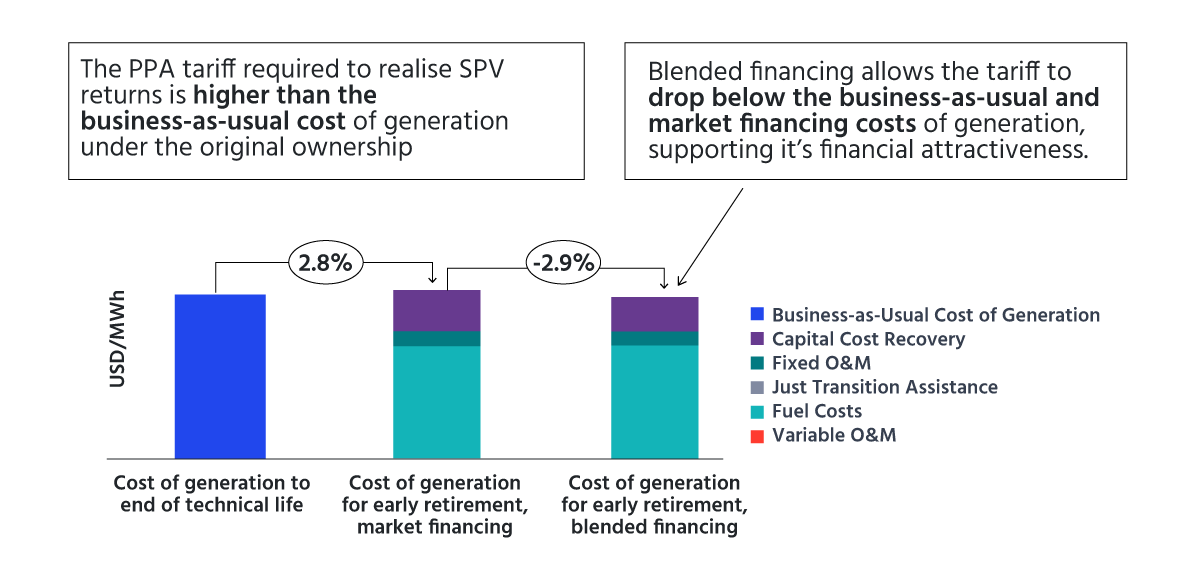

- Blended Finance Makes Early Retirement Attractive

- Under a business-as-usual case, running Pelabuhan Ratu to 2043 results in higher long-term costs.

- With early retirement in 2037 and market-rate finance, required tariffs exceed business-as-usual levels.

- However, when blended finance is introduced, tariffs fall 2–3% below business-as-usual costs. This demonstrates that concessional financing is decisive in making early retirement cost-neutral or better.

- Solar + Storage Repurposing Yields the Strongest Benefits

- Repurposing the site with solar PV and battery storage creates both financial and climate upside.

- Depending on land availability and system sizing, this pathway could generate tens of millions of dollars in free cash flow to equity investors.

- Emissions abatement is significant: repurposing with clean energy could avoid tens of millions of tons of CO₂ over the lifetime of the asset compared to continued coal operation.

- Larger system sizes (enabled by securing adjacent land) deliver the biggest gains: higher profits, deeper emissions cuts, and reduced reliance on other fossil assets in the grid.

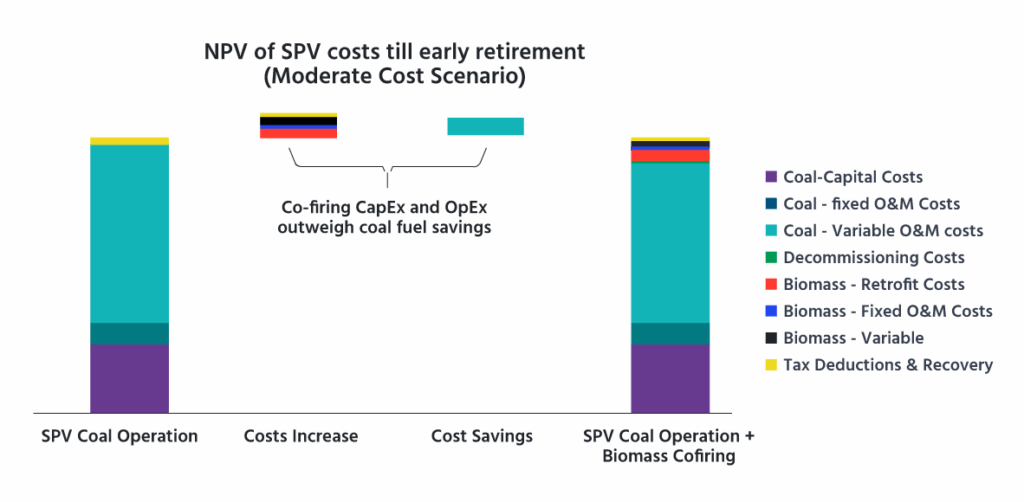

- Biomass Co-Firing Is Not Competitive

- Retrofitting Pelabuhan Ratu for biomass co-firing is only profitable under the very lowest cost assumptions.

- Across most cost scenarios, additional retrofit and operating expenses outweigh any fuel savings.

- Beyond weak economics, biomass co-firing would face sustainability and climate scrutiny, which could further undermine its viability.

- Future Repurposing Options Could Expand

- Options like stand-alone storage, hybridisation of coal and solar, or flexible coal operation could become viable if regulatory frameworks evolve.

- These could provide additional system value but currently lack remuneration models under the existing market paradigm.

Impact

RMI’s analysis of Pelabuhan Ratu is an early and practical demonstration for Indonesian stakeholders of how coal transition mechanisms could work in practice:

- Proof of Concept for ETM

By showing that blended financing can bring tariffs below business-as-usual, the project will support the establish of replicable models for ETM-supported coal retirements. - Clear Guidance on Repurposing Pathways

The analysis provides PLN and PT Bukit Asam with a rigorous, comparative view of retirement and repurposing options. It clearly demonstrates that clean energy replacement is both more cost-effective and more climate-positive than co-firing or early retirement without replacement. - Integration of Just Transition Principles

The inclusion of workforce transition and community support costs in the financial analysis highlights the importance of embedding just transition considerations directly into early-stage technical assistance. - Catalyst for Scaling Transition

As one of the first ETM pilot projects, Pelabuhan Ratu can strengthen stakeholder confidence that Indonesia’s broader 2030 and 2050 targets are achievable, provided that financial, technical, and regulatory considerations are addressed.

Lesson learned

- Blended financing helps ensure electricity costs remain stable: The lower cost of blended financing further supports deal attractiveness to financial stakeholders by allowing for a reduction in costs below the business-as-usual scenario where the coal plant is run to the end of its technical life. This supports a key conclusion about the energy transition in Indonesia and the rest of the Global South — diverse arrays of capital are needed to make the energy transition an affordable and re-allocative one.

- Land availability shapes outcomes: The sizing of the clean energy system and its associated benefits are constrained by available land. The key sizing consideration is whether additional land area — and how much land — around the original site can be utilized, which will require further technical and environmental analysis. These land considerations are key to the broader coal transition discussion and opportunity in Indonesia.

- Asset-specific analysis is critical: Biomass co-firing proved non-competitive at Pelabuhan Ratu except under the most favorable cost assumptions. However, the economics of co-firing vary significantly on an asset-by-asset basis. Given the strong interest in co-firing in Indonesia, modeling asset-specific considerations in early technical assistance work can help inform discussions and future analyses on the co-firing narrative.

- Pilots build trust and replication potential: Early, well-documented analyses like Pelabuhan Ratu help align stakeholders and create templates for broader application across Indonesia’s coal fleet. They can provide clear demonstration of how innovative market and policy solutions could open the door to future business models for these technical, financial, and regulatory alternatives.

Contact

Interested in supporting the coal transition? Get in touch.